Holiday Credit Card Offers

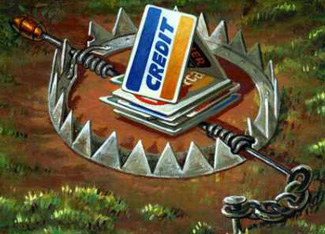

If you think you have been bombarded with credit card offers throughout year, wait until the holiday season rolls around. Holidays bring more credit card offers than at any other time of the year. However, it doesn’t mean that it’s to your benefit.

When you receive a credit card application in the mail, it may seem tempting. An offer of 0% APR for six months, combined with several blank checks which you can use for purchases or consolidation of other debts may be irresistible, but your best course of action would be to shred the entire document.

If you read the back of the offer, you will notice that the APR can be as high as 19% or more after the initial offer ends. Thus, you may save money initially, but sooner or later those high interest rates are going to kick in and you are faced with additional ongoing debt.

One of the most disturbing aspects of these credit card offers is that they are sent to just about anyone who is listed in the white pages. Imagine senior citizens, who live on their social security and barely make ends meet, being presented with an offer they feel will make their lives a little easier. We know it will not. They become victims of a system that preys on unsuspecting individuals who do not realize the consequences of applying for credit. They look at those blank checks and think they’ve won the lotto!

These credit card offers are also sent to students who, because they may not fully understand the pitfalls of credit card debt, willingly apply for credit and suffer the consequences later. There was one case cited wherein a teen applied for a credit card and ran up bills totaling $5000.00. Statistics show that it would take several years to pay it off and the interest accrued would amount to more than $3000.00. That’s $8000!

Due to the sub-prime mortgage crisis, many banks have deferred offering credit and have added new requirements for those who apply. Yet, this does not stop them from sending out application upon application to those who either can’t afford it or can suffer serious financial setbacks if they do.

If you receive credit card offers in the mail, the best advice one can offer is to tear up the envelope or shred it. Don’t even open it. This is especially true if you already have ongoing credit card debt. Adding fuel to the fire will not help you in the long run, and can hurt your credit score as well.