If you’ve ever had credit in your name, there’s a good chance that you get credit card offers in the mail regularly. Some charge interest rates so ridiculous that it’s amazing they’re still in business. Others offer deals that seem too good to be true, such as 0% balance transfers.

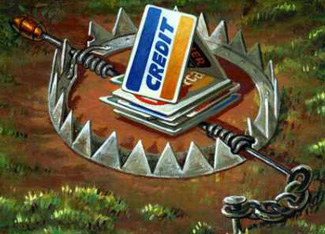

Zero interest deals do exist, though. In fact, they’re pretty common. Credit card companies offer such deals because they provide an incentive for those who already have credit card debt to get one of their cards. But should you take the bait? Here are some points to consider when making that decision.

Pros

Zero interest is almost certainly a better deal than you’re getting with another card. Even if it’s only for a limited time, it could save you quite a bit of money. As long as the non-promotional interest rate is the same as or less than your current card, you should come out ahead.

If you’re planning to pay off your debt, transferring your balance could allow you to do it more quickly. Instead of contending with compound interest until you finally get it all paid, you can put the entire amount of each payment toward the principal.

Having another credit card account reduces your outstanding debt to available credit ratio. This is good for your credit rating, and can help you get lower interest rates on mortgages and other types of loans.

Cons

For those who already have too much debt, getting another credit card could be a bad idea. That paid-off credit card might look like an open invitation to charge. If you accept that invitation, you could end up with much more debt than you had to start with.

Zero interest doesn’t necessarily mean free. Most cards charge a fee each time you transfer a balance. These fees are usually a fraction of the regular interest rate, but if you transfer a large balance it could add up to a lot of money.

Some cards that offer 0% balance transfers make up for it by charging high fees for other things. They may jack up your interest rate if a payment is late or returned by the bank, or they could charge high annual fees. Be sure to read the fine print, because they are required by law to disclose such things.

Transferring a balance to a zero interest credit card can save you lots of money. But if you just charge up the original card again, you’re worse off than you were to start with. Even if you don’t, fees could add up to more than you realize. Before you accept that balance transfer offer, make it a point to do some research.